22 Sep 2023

22 Sep 2023

In a world where digital banking is becoming increasingly prominent, Monzo has once again taken a significant step forward. They’ve recently introduced a new feature within their banking platform – Monzo Investments. This development is not just another addition to their already impressive suite of services; it’s a glimpse into the future of digital banking and the changing dynamics of the financial landscape.

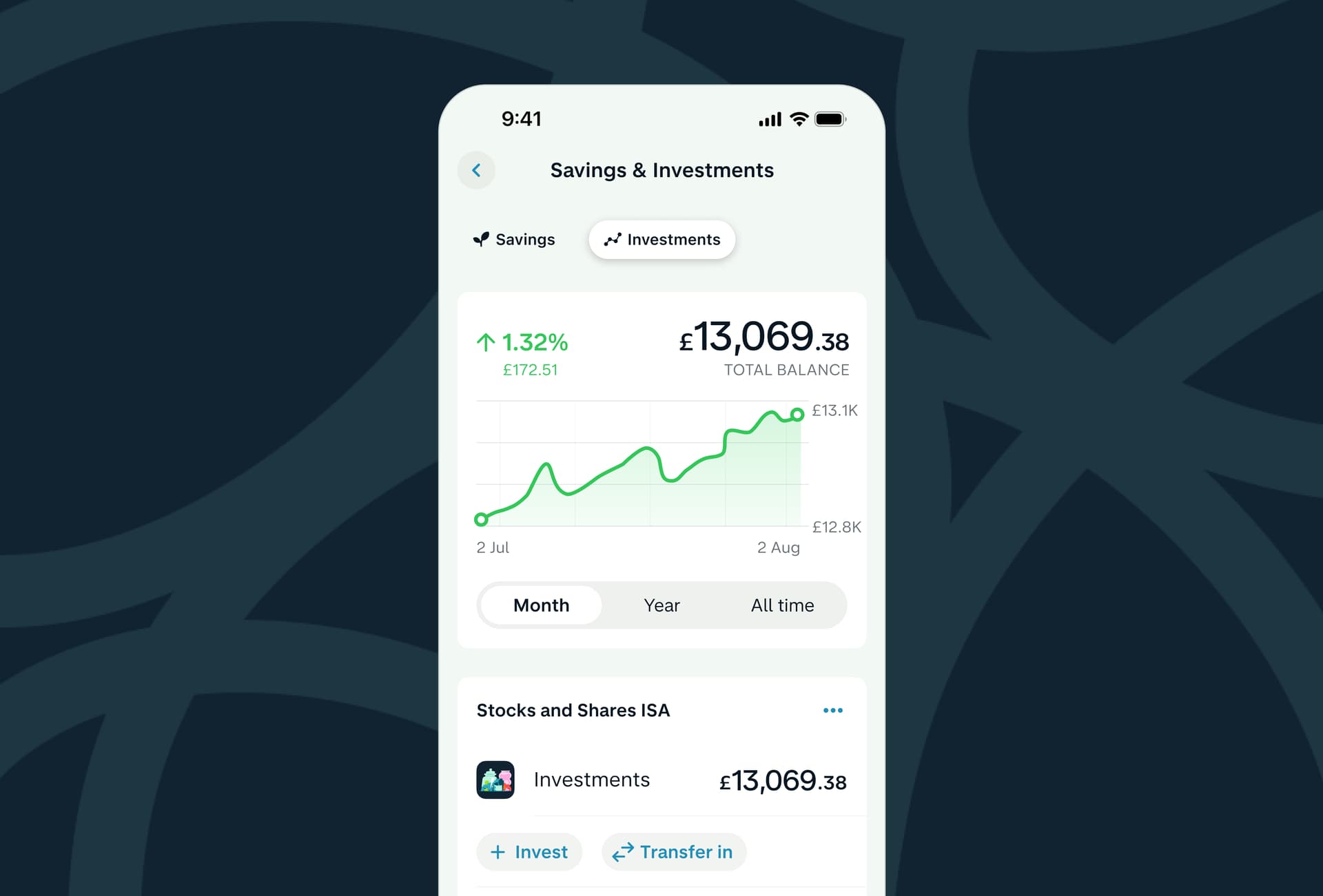

Monzo Investments offers users the opportunity to invest in three different funds directly through their mobile app. What sets this apart is not just the accessibility but the sheer ease of use. With a user-friendly interface, Monzo has made it simpler than ever for everyday individuals to dip their toes into the world of investments.

This move by Monzo is significant for several reasons. It not only reflects their commitment to providing a holistic financial experience but also recognises the changing preferences of their users. As more people seek non-traditional ways to grow their wealth, digital banks like Monzo are responding with innovative solutions.

The trend of investing through mobile apps is on the rise, and for good reason. These apps offer a level of convenience and accessibility that was unimaginable just a few years ago. With a few taps on their smartphones, users can now access a range of investment options, monitor their portfolios, and make informed decisions – all from the palm of their hand.

The simplicity and flexibility offered by app-based investments are reshaping the way people manage their finances. As more and more individuals turn to these platforms, it becomes crucial for financial advisors to adapt and stay in sync with the evolving landscape.

Central to this transformation is the concept of open finance. It’s a paradigm shift that’s driving innovation in the financial sector. Open finance focuses on data accessibility, enabling consumers and financial advisors to access a wealth of information seamlessly.

As more individuals invest through apps, the need for financial advisers to have access to this data grows. It’s essential for advisors to be able to evaluate their clients’ portfolios comprehensively. This is where platforms like Fuze come into play.

With the rise of more of these investment apps, it becomes increasingly important for financial advisors to have a comprehensive view of their clients’ investments across various platforms. This is where the aggregation capabilities of Fuze come into play.

Fuze is designed to seamlessly consolidate all of your clients’ financial data, including their investments in apps like Monzo, into one unified platform. It provides financial advisers with the necessary tools to gain insights into these investments, enabling them to offer more informed advice and make strategic decisions that align with their clients’ financial goals.

By aggregating data from diverse sources, Fuze empowers financial advisors to see the bigger picture. They can assess how these investments fit into the broader financial landscape, ensuring a well-rounded and diversified portfolio. This level of visibility is crucial for delivering tailored financial guidance and helping clients navigate the evolving financial landscape effectively.

While app-based investments offer incredible accessibility and convenience, they don’t replace the invaluable role of a financial advisor. Financial advisers bring a depth of knowledge, experience, and personalisation to the investment process that algorithms and apps cannot replicate.

Benefits of Having a Financial Adviser:

In conclusion, Monzo’s new investment feature is more than just a feature; it’s a testament to the changing dynamics of the financial world. As the trend of investing through apps gains momentum, the importance of open finance and comprehensive financial data becomes increasingly apparent.

We’re excited to see how apps like Monzo will continue to shape the financial landscape. Moreover, we’re here to support financial advisers in this evolving landscape with Fuze, providing the tools they need to provide the best possible service to their clients.

Interested in learning more about how Fuze can help you navigate the changing financial landscape? Contact us to explore how Fuze can benefit your financial advisory services.